As Turkey continues to evolve and grow, its economic landscape offers both challenges and opportunities for traders. This article delves into how economic trends in Turkey influence market conditions and trading strategies. By examining key factors that drive Turkey’s economy, traders can gain a deeper understanding of how to effectively navigate this vibrant market.

With a focus on Trading in Turkey, we will explore how various trends and events impact market dynamics and offer actionable insights to help traders capitalize on emerging opportunities. This comprehensive analysis aims to equip traders with the knowledge and tools needed to excel in Turkey’s ever-changing economic environment.

Overview of Turkey’s Economy

Turkey, strategically located at the crossroads of Europe and Asia, stands as a vital economic hub for those engaged in Trading in Turkey. The country’s economy boasts a diverse range of industries, including manufacturing, agriculture, tourism, and services. Over recent decades, Turkey has evolved significantly, transitioning from an agrarian society to a prominent industrial powerhouse.

This dynamic economic transformation presents numerous opportunities for traders. Understanding Turkey’s diverse economic landscape is essential for effectively navigating and capitalizing on the evolving market. As Turkey continues to grow and diversify, it offers valuable prospects for those involved in Trading in Turkey

- *GDP and Economic Growth*: Turkey’s Gross Domestic Product (GDP) has shown resilience despite global economic challenges. The country has maintained a steady growth rate, driven by strong domestic consumption and investment in infrastructure projects.

- *Inflation and Monetary Policy*: Inflation has been a persistent issue in Turkey, with rates often exceeding the central bank’s targets. The Central Bank of the Republic of Turkey (CBRT) plays a crucial role in managing inflation through monetary policy adjustments, including interest rate changes.

- *Unemployment and Labor Market*: The labor market in Turkey is characterized by a relatively high unemployment rate, particularly among the youth. However, the government has implemented various initiatives to boost employment and support job creation.

- *Trade and Foreign Relations*: Turkey’s strategic location makes it a vital trade hub, with strong ties to both European and Asian markets. The country is a member of various international organizations, including the World Trade Organization (WTO) and the G20, which influence its trade policies and economic relations.

Key Economic Trends Influencing Market Opportunities

Understanding key economic trends is essential for traders looking to capitalize on market opportunities in Turkey. By staying informed about these critical trends, traders can navigate the complexities of Trading in Turkey more effectively. Monitoring factors such as economic growth rates, inflation, and industry shifts will provide valuable insights and help traders make strategic decisions in this dynamic market.

- *Economic Reforms and Policies*: The Turkish government has implemented several economic reforms aimed at boosting growth and attracting foreign investment. These reforms include tax incentives, deregulation, and infrastructure development projects. For instance, the Istanbul Financial Center project aims to position Istanbul as a global financial hub, creating new opportunities to trading in turkey for traders and investors.

- *Geopolitical Developments*: Geopolitical events, such as regional conflicts and diplomatic relations, can significantly impact Turkey’s economy. For example, Turkey’s involvement in regional conflicts and its relations with neighboring countries can influence market stability and investor sentiment. Traders should stay informed about geopolitical developments and their potential effects on market opportunities.

- *Technological Advancements*: Technological innovations are transforming various sectors of Turkey’s economy, including finance, manufacturing, and agriculture. Embracing new technologies can create investment opportunities and drive economic growth. For example, the rise of fintech companies in Turkey is revolutionizing the financial sector, offering new avenues for investment.

- *Tourism Industry*: Turkey’s tourism industry is a vital contributor to the economy, attracting millions of visitors each year. Trends in tourism, such as changes in travel preferences and global travel restrictions, can influence economic performance. For instance, the recovery of the tourism sector post-pandemic can create opportunities for traders in related industries, such as hospitality and transportation.

- *Energy Sector*: Turkey’s energy sector is undergoing significant changes, with a focus on renewable energy sources and reducing dependence on imported energy. Developments in the energy sector can impact economic growth and investment opportunities. For example, the government’s push for renewable energy projects, such as wind and solar power, can create new investment opportunities for traders.

Analyzing Market Opportunities in Turkey

To effectively navigate Turkey’s economy and excel in Trading in Turkey, traders must thoroughly analyze various market opportunities and their potential impacts. Here are some key areas to focus on when navigating Turkey’s economy:

- *Equity Markets*: Investing in Turkish stocks can provide exposure to the country’s economic growth. Traders should focus on sectors with strong growth potential, such as technology, healthcare, and consumer goods. For example, companies in the technology sector, such as software and e-commerce firms, are poised for growth due to increasing digitalization.

- *Forex Markets*: The Turkish lira (TRY) is a popular currency for forex traders due to its volatility. Traders can take advantage of fluctuations in the lira’s value by monitoring economic indicators and geopolitical developments. For instance, changes in interest rates and inflation can impact the value of the lira, creating trading opportunities.

- *Commodity Markets*: Turkey is a significant producer of various commodities, including agricultural products and minerals. Traders can invest in commodities such as gold, silver, and agricultural goods to diversify their portfolios. For example, Turkey’s agricultural sector, known for producing high-quality fruits and vegetables, can offer investment opportunities in export markets.

- *Real Estate Markets*: Turkey’s real estate market offers attractive investment opportunities, particularly in major cities like Istanbul and Ankara. Investing in real estate can provide long-term returns and hedge against inflation. For example, the demand for residential and commercial properties in Istanbul continues to grow, driven by urbanization and population growth.

- *Fixed-Income Markets*: Government and corporate bonds in Turkey can offer stable returns for risk-averse investors. Traders should consider the credit ratings and interest rate environment when investing in fixed-income securities. For instance, government bonds with higher yields can attract foreign investors seeking stable returns.

Tools and Resources for Traders

To succeed in Trading in Turkey’s economy, accessing the right tools and resources is essential. Navigating Trading in Turkey’s economy effectively involves using advanced trading platforms, up-to-date market data, and economic forecasts. Traders need these key resources to analyze market trends and make informed decisions in Turkey’s dynamic economic environment. By leveraging these tools, traders can enhance their strategy and capitalize on opportunities in Turkey’s evolving marke

- *Trading Platforms*: Reliable trading platforms provide real-time data, charting tools, and order execution capabilities. Popular platforms for trading Turkish assets include MetaTrader, TradingView, and Interactive Brokers.

- *Economic Calendars*: Economic calendars track important events and data releases that can impact the market. Websites like Investing.com and Forex Factory offer comprehensive economic calendars for Turkey.

- *Financial News and Analysis*: Staying informed about market news and analysis is crucial for making informed trading decisions. Websites like Bloomberg, Reuters, and Hurriyet Daily News provide up-to-date financial news and analysis on Turkey’s economy.

- *Educational Resources*: Continuous learning is essential for traders. Books, online courses, webinars, and trading communities can provide valuable insights and knowledge. Some recommended resources include “The Intelligent Investor” by Benjamin Graham and online courses from Coursera and Udemy.

Risk Management in Trading

Effective risk management is crucial for long-term success in trading in turkey’s economy. To navigate trading in turkey’s market successfully, traders should employ several key techniques to manage risk. Implementing strategies such as setting stop-loss orders, diversifying investments, and regularly reviewing portfolio performance can help mitigate potential losses. By integrating these risk management techniques, traders can enhance their ability to make informed decisions and sustain success in trading in turkey’s dynamic economic landscape

- *Diversification*: Diversifying your portfolio by investing in different asset classes and sectors can help reduce risk. This way, poor performance in one area can be offset by gains in another.

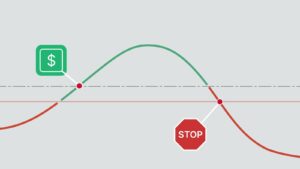

- *Stop-Loss Orders*: Setting stop-loss orders helps limit potential losses by automatically selling an asset when it reaches a predetermined price.

- *Position Sizing*: Determining the appropriate position size for each trade based on your risk tolerance and account size can help manage risk. Avoid risking too much capital on a single trade.

- *Hedging*: Hedging involves taking offsetting positions to reduce the risk of adverse price movements. For example, traders can use options or futures contracts to hedge against potential losses in their portfolios.

- *Regular Review and Adjustment*: Regularly reviewing and adjusting your trading strategy based on market conditions and performance can help manage risk and improve returns.

Case Studies: Successful Trading Strategies in Turkey

To illustrate how economic trends influence market opportunities trading in turkey, let’s look at some case studies of successful trading strategies in Turkey. By examining these examples, we can understand how effective trading in turkey can capitalize on various economic trends and dynamics. These case studies highlight the impact of strategic decision-making and market analysis in Navigating Turkey’s economy and leveraging growth opportunities.

- *Case Study 1*: Investing in Technology Stocks: A trader identified the growing trend of digitalization in Turkey and invested in technology stocks, such as software and e-commerce companies. By analyzing market trends and company performance, the trader was able to capitalize on the sector’s growth and achieve significant returns.

- *Case Study 2*: Forex Trading in Turkey with the Turkish Lira: A forex trader monitored economic indicators, such as inflation and interest rates, to predict fluctuations in the Turkish lira’s value. By using technical analysis and staying informed about geopolitical developments, the trader successfully executed profitable trades in the forex market.

- *Case Study 3*: Real Estate Investment in Istanbul: An investor recognized the demand for residential and commercial properties in Istanbul and invested in real estate projects. By analyzing market trends and demographic data, the investor was able to achieve long-term returns and hedge against inflation.

Conclusion

Trading in Turkey requires a deep understanding of the country’s economic trends and their impact on market opportunities. Navigating Turkey’s economy effectively involves staying informed about economic reforms, geopolitical developments, and technological advancements that shape the market. By leveraging insights into these factors, traders can identify lucrative opportunities and make strategic decisions in trading in turkey.

Employing effective trading strategies, utilizing advanced tools and resources, and implementing robust risk management techniques are crucial for enhancing success in trading in turkey. As Turkey’s economy continues to evolve, keeping up with the latest trends and continuously learning will be essential for successfully navigating this dynamic market. Mastering the art of Trading in Turkey requires vigilance and adaptability to seize the full potential of the country’s economic landscape.